5 answers to common online payment questions

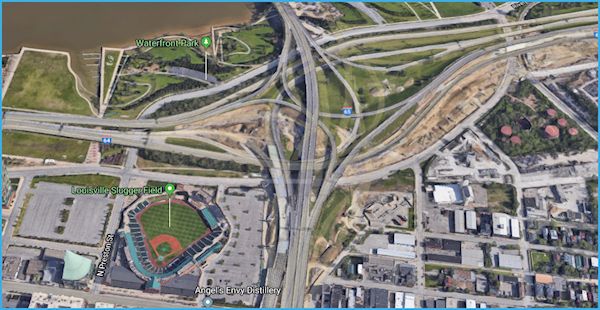

The I-64/65/71 interchange in Louisville, locally known as Spaghetti Junction, is often listed as one of the most convoluted interchanges in America. We here at Learning Stream in Louisville are proud to navigate, and thus far, survive this monstrosity. Perhaps nothing can rival a convoluted interchange’s convolutedness like the online payment world.

So much about online payment processing, from seemingly interchangeable terms to myriad fees, can make it harder to navigate than Spaghetti Junction. Let’s go the opposite direction of America’s urban highway system and keep things simple. Below are five questions about, and answers to, typical online payment questions.

- What is the difference between a gateway and a processor?

Gateways, including Authorize.net and PayPal’s Payflow Pro, are necessary for card-not-present transactions, aka online payments. When a person submits a payment online, the gateway usually says Yep, this is legit and sends the encrypted transaction data to the processor. If the gateway sees something about the card number or other information that not right, it blocks the transaction from going any further. Processors like Elavon talk to the bank that issued the credit card; the company selling the product and service; and that company’s bank, which is where the money eventually lands. - How do I know if the payment gateway and processor are secure?

Any company involved along the spectrum of credit card processing, including registration management platforms, can provide documentation of current PCI compliance. The Payment Card Industry Data Security Standard (PCI DSS) means to ensure everyone involved in accepting, transmitting or storing credit card information meets a high level of security. Requirement levels vary depending on various details such as amounts processed or services provided, such as payment gateways, processors, software providers in the case of online payments, and businesses that accept credit card payments. If a company can’t provide proof of PCI compliance, look elsewhere. - What kind of reporting tools will a payment processor provide? Online payment gateways and processors provide basic transaction information such as customer name, payment amount, settled/declined, and settlement date and time. If you’re accepting payments in conjunction with a full registration management system, you’ll have lots of reporting options within that software. The data can be compared against what you receive via your gateway or processor.

- Is a merchant account just another bank account?

We would never want to impugn the importance of a bank account. But merchant accounts are something beyond your regular bank account. To collect online payments using a payment gateway, you would set up a merchant account with your bank or other financial institution. The processor will send the money paid, minus fees, to the merchant account. From there, you can transfer the money to a regular bank account. - How long does it take online payments to appear in my account?

Processors don’t send paid funds (aka settling) to your account each time someone pays for your service or product. They do so in batches—often at the end of the day. That’s why you’ll come across batch fees when comparing the prices of gateways and processors. Commonly, transactions appear in your account in one to two days.

Well done. Only five facts about the online payment realm, and you already know more than most people. If you want to discuss further, we’d love to hear from you.